Wave 1 of lightweighting focused on material reduction. Wave 2 involved using lighter, traditional materials. Wave 3 focuses on composites and other more exotic materials, but what processes are available to work with these new materials?

After most of the potential gains were realized from reducing the amount of metal, the next wave of lightweighting focused on moving toward lighter materials, mainly aluminum and plastics. This was a bit of a back-to-the-future approach, since the 1909 Ford Model T Touring Car used aluminum body panels until it switched to steel in 1918.

Year over year, the result of removing excess materials and switching to lighter-weight aluminum and plastic parts has displaced about 20% of traditional components, with the biggest gains in larger frame and body parts. On average, a 2022 US passenger car will contain around 220 pounds of aluminum.

The 3rd Wave of Lightweighting

But the thickness of parts can only be reduced so far, and there are applications where aluminum and plastic can’t be used. That’s why the third wave of lightweighting focuses on radically different high- or ultra-high-strength materials including carbon fiber, reinforced composites, and alloys incorporating magnesium and titanium.

But parts made with these materials are seldom produced using traditional stamping or hot-working processes. That leaves Tier suppliers striving to identify new processes able to produce parts that meet OEM specs at acceptable cycle times and production costs.

Computer Numerical Control (CNC) lasers showed early promise based on their high accuracy, repeatability and quality, but they offered relatively low throughput. Integrating robotics improved cycle times, but not enough. Still, most robots lacked the ability to accurately cut holes at specified 0.1 mm tolerances, and the quality of the holes often didn’t meet customer specs.

A final problem is that, unlike a shear or press, CNC can’t be readily dropped into a production line. The actual laser head is relatively compact but the related CNC transport system requires as much as 30 linear feet of space.

Cutting-Edge Laser-Cutting Solution

One promising solution combines several proven technologies with an innovative addition: A 2-axis laser positioner called NEWTON added to a 6-axis robotic arm. The robot repeatably locates the laser on the part while the NEWTON positioning device provides the fine laser motion (path accuracy of ±0.05 mm) as it cuts.

One analysis showed that 90% of holes in automotive parts fall within a 30 × 30 mm square operating range, which matches the capabilities of the positioner. The robot/positioner/laser combination works at far higher speeds and accuracy than previously possible via direct robot articulation of the laser.

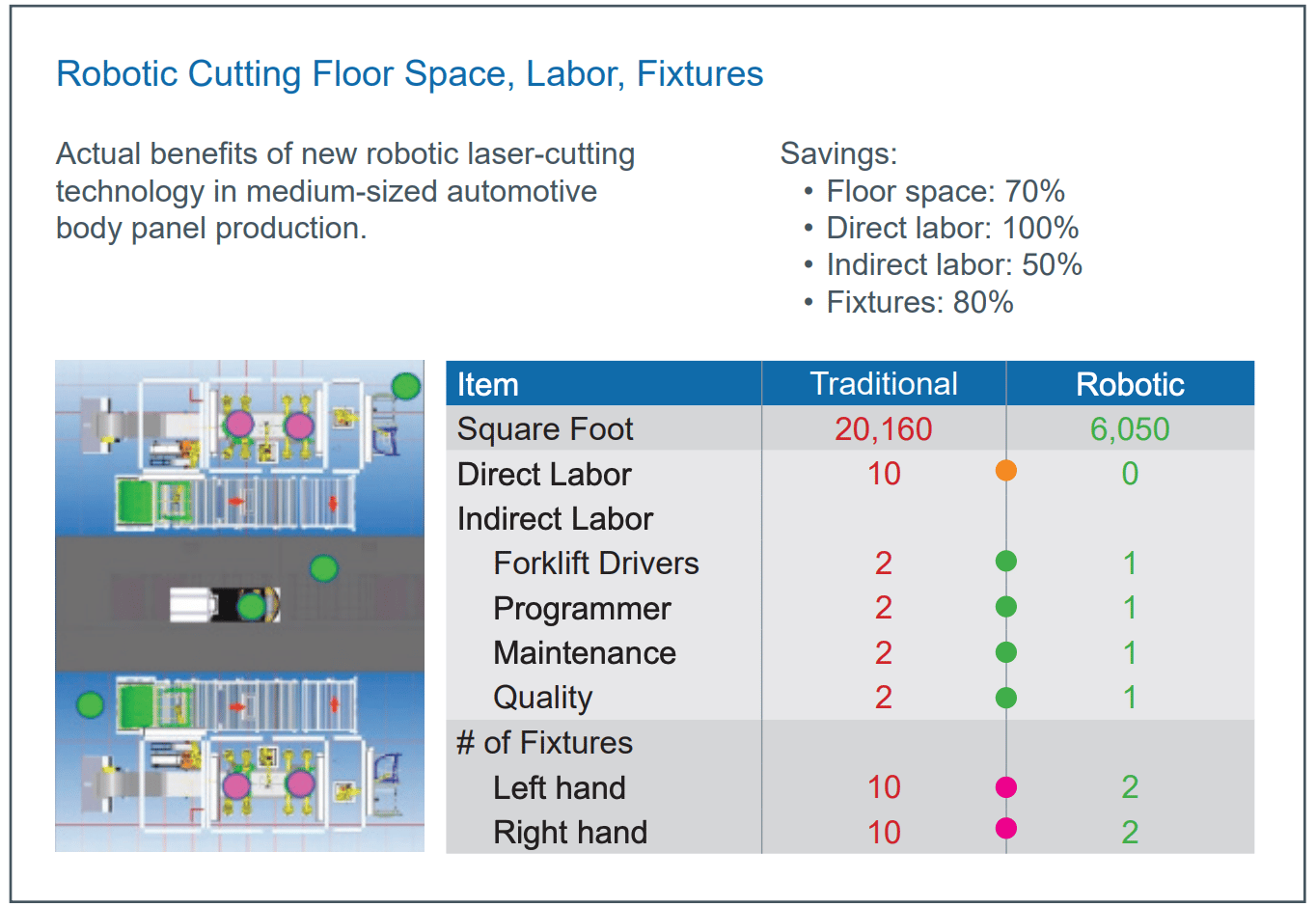

Cycle-time reduction compared to a typical 6-axis articulated cutting robot is nearly 70 percent. Multiple lasers – as many as eight – can be incorporated within a single, compact laser-cutting production cell. The number of cutting heads makes this production technique especially valuable in producing structural panels and components with many holes, like the EV battery tray. One real-world success story was a multi-head robotic laser-cutting center that replaced 10 CNC laser-cutting stations.

New Materials, New Opportunities

There were hardly any composites available for automotive components five years ago, and the ones that existed were very expensive. Today there is a long list of more-affordable, new composites and materials. Importantly, there are also technologies and processes available to work with these materials, enabling a rethinking of both products and processes.

But as with any new technology, there are risks: risks of betting on the wrong technology and getting no payback on your investment; risks of poor process-to material matches, resulting in unrealized productivity targets; risks of materials not performing as expected, resulting in warranty claims and recalls.

Those exploring the use of these new materials can minimize their risks by seeking out integrators and other expert organizations with experience in these innovations. The number of these organizations is relatively small, but it’s worth seeking them out. They can help ensure that you find the shortest, lowest-cost path to new and possibly breakthrough lightweighting advancements.

Recent Comments