The use of aluminum in vehicle components is growing, but part manufacturers remain uncertain about the best production processes.

Automation integrators are eager to share the successful solutions and discoveries they’ve developed.

Automotive manufacturers were using aluminum in their vehicles over a century ago. A 1908 Bugatti included extensive aluminum sand castings and formed-aluminum body panels. Some date the first use to pre-1900 in a sports car built by Karl Benz. The lightweighting provided by aluminum improved the car’s performance. But Benz, like other car makers at the time, lacked knowledge about the material and had difficulties working with it. As a result, aluminum failed to gain traction in the automotive industry.

Today, improved alloys and intense pressure toward lightweight vehicles has aluminum back at center stage. One industry watcher predicts aluminum content will grow to 514 pounds per vehicle by 2026, up by 12% from 2020 levels. Aluminum applications have been primarily limited to body panels, trim and closures in the past, and there was mixed success with aluminum engine blocks. The range of applications today is far wider.

Electric vehicles (EVs) present an especially rich opportunity for increased use of aluminum, where it is widely used in structural and frame applications. But like Karl Benz over 100 years ago, most manufacturers still lack solid knowledge of how to best work with aluminum. And process designers and automation integrators are developing the expertise and production processes needed to expand the use of aluminum in vehicles and to accelerate lightweighting efforts.

Other lightweighting materials have helped pave the way for some manufacturers in the development of the new processes being used today for aluminum. The laser machine building industry have designed and developed laser processing tools for Ultra-High Strength Steel (UHSS) products. The knowledge gained from over a decade of development can now transition these technologies into the structural aluminum trend. Examples include: complex aluminum extrusions, High Pressure Die Cast Aluminum Molding (HPDCA), ultra-high strength hot stamped aluminum, and hydro-formed high strength tube structures.

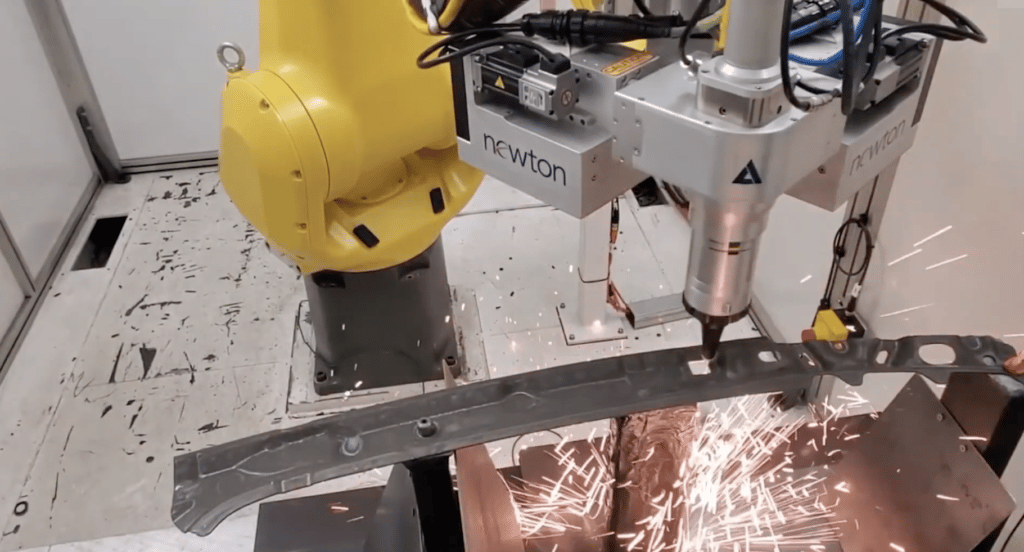

CNC machine tools have long been the heroes of traditional metal-component-manufacturing processes. With many metals, and especially aluminum, lasers are proving to be a superior production process in many ways. Lasers are especially well suited to working with the aluminum extrusions used in EVs for “skateboard platforms” and other structural components that support vehicles, as well as battery trays.

Start with process speed. A CNC mill, for example, will take anywhere from 2 to 6 seconds to drill a hole, while a laser can do the job in 0.5 seconds. Hole- size changes are instantaneous with a laser, as are transitions between feature shapes, holes, squares, rectangles etc. The same laser can cut all of those features with no tool or machine change, making cycle time with a laser vastly superior.

The high throughput of laser-cutting devices means that a single robot-guided laser can do the same job as three or more CNCs in a typical production process. This significantly reduces capital investment, both related to the production machine as well as the material handling/movement infrastructure needed to support it.

Ongoing labor costs are also far less. Your maintenance team has one laser to maintain rather than multiple CNCs. And there’s one laser to load/ unload rather than three CNCs, reducing direct labor. Finally, there’s the reduced floor space. The related costs are significant. Overhead costs in a typical existing plant are between $10 and $12 per square foot, while construction costs for a new facility are in the $200-$300 square foot range.

Improved process configuration

Besides the direct dollars-and-cents advantages of lasers over CNC machine tools, lasers are easier to incorporate in your production processes. CNCs, with their strict control architectures, are traditionally not very automation friendly. It’s challenging to incorporate them into the upstream and downstream processes, while a laser is relatively easy to drop directly into a line.

The larger number of CNCs required compared to lasers also increases the congestion in production cells, making it harder to refine or reconfigure processes. There’s also the increased congestion created by additional part racks and load/unload systems. Overall equipment effectiveness (OEE) for lasers is higher along almost every parameter compared to CNCs.

Part quality is also high. Like CNCs, lasers reliably produce consistently uniform parts. But in a cell with three CNCs performing the same operation – three part paths – there will always be variability between each machine as dies and fixtures wear. The single laser introduces less variability, achieving impressive process-capability-index (Cpk) metrics.

Enabling new aluminum applications

Lasers do a tremendous job cutting surface holes, slots and features in aluminum 2 to 10 mm thick, but they aren’t magical light sabers; they do have limitations. One example is that they can’t cut through layered metal or where there’s an air gap. In those situations, a traditional drill remains the right tool for the job.

Overall though, OEMs and tier suppliers are consistently amazed by the speed and number of operations that can be performed by a laser. They are also impressed by the ability of a single laser to perform all needed cutting operations to produce a finished part.

Process designers and automation integrators are eager to share their emerging knowledge related to production methods for aluminum automotive components, supporting continued vehicle enhancements and helping achieve lightweighting goals.

Recent Comments